Pacific Prime Fundamentals Explained

Pacific Prime Fundamentals Explained

Blog Article

What Does Pacific Prime Do?

Table of ContentsPacific Prime Fundamentals ExplainedThe Single Strategy To Use For Pacific Prime8 Easy Facts About Pacific Prime ExplainedGet This Report about Pacific PrimePacific Prime Can Be Fun For Anyone

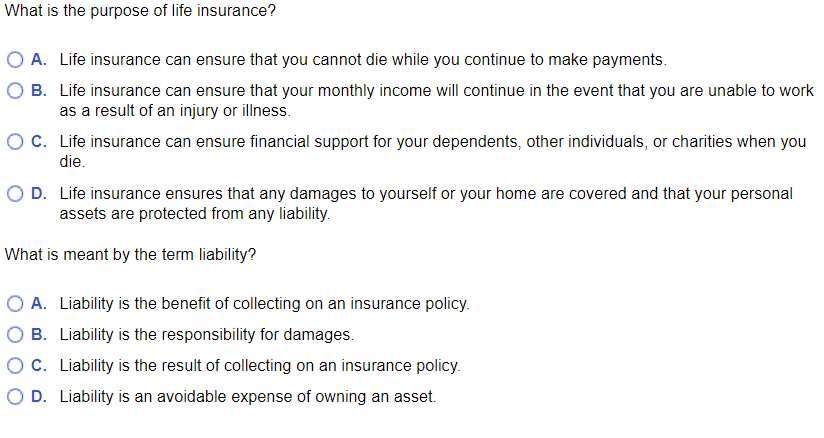

Insurance coverage is a contract, stood for by a policy, in which a policyholder obtains financial defense or compensation against losses from an insurance provider. The company pools customers' risks to make settlements a lot more budget-friendly for the guaranteed. The majority of people have some insurance: for their cars and truck, their home, their healthcare, or their life.Insurance coverage also assists cover expenses related to liability (lawful responsibility) for damage or injury triggered to a third event. Insurance coverage is an agreement (policy) in which an insurer indemnifies an additional versus losses from particular contingencies or risks. There are many kinds of insurance coverage. Life, health, home owners, and vehicle are amongst one of the most usual kinds of insurance.

Investopedia/ Daniel Fishel Many insurance plan kinds are available, and virtually any specific or organization can locate an insurance provider ready to insure themfor a cost. Usual personal insurance plan types are car, health, house owners, and life insurance policy. Most people in the United States have at the very least among these types of insurance, and cars and truck insurance coverage is needed by state legislation.

Pacific Prime for Dummies

So discovering the rate that is ideal for you calls for some legwork. The plan limitation is the optimum amount an insurer will spend for a covered loss under a plan. Optimums may be set per period (e.g., annual or plan term), per loss or injury, or over the life of the plan, likewise called the life time optimum.

Policies with high deductibles are typically cheaper due to the fact that the high out-of-pocket cost generally causes fewer little claims. There are various sorts of insurance coverage. Allow's check out the most crucial. Medical insurance assists covers routine and emergency treatment prices, commonly with the option to include vision and oral services independently.

Several preventive solutions might be covered for free before these are satisfied. Health insurance coverage may be purchased from an insurance coverage company, an insurance policy representative, the government Wellness Insurance Marketplace, provided by a company, or government Medicare and Medicaid insurance coverage.

Some Known Factual Statements About Pacific Prime

The company then pays all or many of the covered costs connected with a vehicle accident or other car damage. If you have a leased automobile or borrowed money to purchase a vehicle, your loan provider or leasing dealer will likely need you to carry car insurance policy.

A life insurance policy policy warranties that the insurance provider pays an amount of cash to your recipients (such as a look at here now spouse or children) if you die. In exchange, you pay costs throughout your lifetime. There are two major kinds of life insurance policy. Term life insurance covers you for a particular duration, such as 10 to twenty years.

Insurance coverage is a method to manage your financial risks. When you buy insurance, you buy defense versus unforeseen monetary losses.

The Single Strategy To Use For Pacific Prime

There are numerous insurance coverage plan types, some of the most usual are life, health and wellness, home owners, and car. The appropriate kind of insurance policy for you will depend upon your objectives and financial circumstance.

Have you ever had a moment while checking out your insurance plan or buying insurance coverage when you've assumed, "What is insurance coverage? And do I truly require it?" You're not alone. Insurance coverage can be a strange and confusing point. How does insurance job? What are the advantages of insurance? And exactly how do you discover the most effective insurance for you? These prevail inquiries, and the good news is, there are some easy-to-understand responses for them.

No one desires something negative to take place to them. Yet enduring a loss without insurance policy can place you in a challenging financial circumstance. Insurance policy is an important financial tool. It can aid you live life with fewer worries recognizing you'll get monetary help after a calamity or accident, assisting you recoup quicker.

The 45-Second Trick For Pacific Prime

And in some situations, like auto insurance and employees' settlement, you might be needed by regulation to have insurance coverage in order to protect others - global health insurance. Learn more about ourInsurance options Insurance policy is essentially a big stormy day fund shared by many individuals (called insurance holders) and handled by an insurance service provider. The insurance provider utilizes cash gathered (called costs) from its insurance policy holders and other investments to spend for its procedures and to accomplish its assurance to insurance policy holders when they sue

Report this page